Updates

Here are the new features in the latest version of Digit App for the blog post without the additional details section:

- Improved performance: The app now runs more smoothly and responsively.

- New UI: The user interface has been redesigned for a more modern and user-friendly experience.

- Bug fixes: A number of bugs have been fixed, including some that were causing crashes.

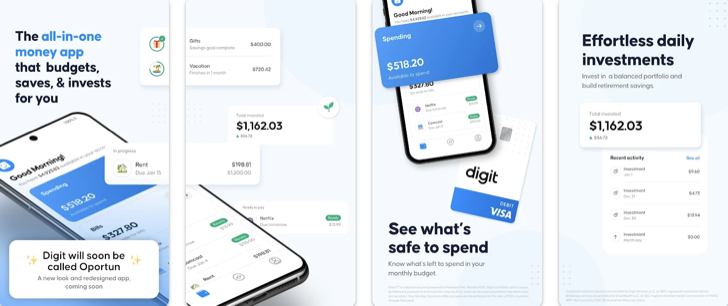

Digit is a bank account app that helps you manage your finances easily. With Digit, you can save, invest, and budget your money efficiently. This app is free for six months, after which a subscription fee of $5 per month applies. Here\'s everything you need to know about Digit.

Digit features several tools that help you manage your money. First, it guides you in budgeting for expenses, bills, savings and investing. Digit\'s budgeting feature is smart and is tailored to your needs by guiding your money where you need more. Also, Digit tells you how much is available to spend so that you can make smarter spending decisions daily.

Secondly, Digit saves you from mental math by automatically transferring a fixed amount of money from your checking account to your savings account. The amount saved daily can be used to achieve various savings goals that you have set. Additionally, investing with Digit is super easy. The app calculates how much to invest based on your spending habit, bills and your savings.

Lastly, Digit\'s Debit Card helps keep your money safe with no ATM fees. You can lock your card with a single tap in-app if you lose it, and get daily balance updates and notifications about your account.

Digit ensures that you spend wisely by telling you how much is available to spend each day. Also, the app is intuitive and easy to navigate. You can set and track your savings goals easily using your account. Moreover, the automatic savings feature means that you do not have to worry about putting money aside. Digit\'s Debit Card has no ATM fees, and you can lock it in the app if you lose it.

One downside to Digit is that it charges a subscription fee of $5 per month after the first six months. Also, the app only supports specific currencies, which may be a hindrance to people who deal with different currencies.

Using Digit is straightforward. The first step is to set up a direct deposit to get paid up to two days early. You can then add your expenses, such as your rent, internet, and cable bills. Inform Digit of your savings and investment objectives. Digit does the rest, planning for today, tomorrow, and way later. You can then use Digit\'s Debit Card to make purchases without incurring any ATM fees.

Q: What happens if I go over my budget?

A: Digit tells you how much is available to spend, so it\'s up to you to stay within your budget. However, if you go over your limit, you can transfer money from your savings or investment account to your checking account.

Q: Is Digit free?

A: Yes, Digit is free for the first six months, after which a subscription fee of $5 per month applies.

Q: Is Digit safe?

A: Yes, Digit is safe. The app uses SSL encryption and stores user data in servers that are protected by 24/7 security teams.

In conclusion, Digit is an excellent app to have if you want to manage your money smartly. The app does most of the work for you by guiding your money where you need it most. Additionally, Digit ensures that you save easily by automatically transferring a set amount of money to your savings account daily.