|

Name:

Venmo

|

|

|

Version:

10.19.1

|

Price:

Free

|

Content

- What is Venmo and How Does It Work?

- Linking Your Bank Account and Cards to Venmo

- Sending and Requesting Money on Venmo

- Venmo Fees and Charges

- Venmo’s Social Feed and Privacy Settings

- Security and Safety Tips for Venmo

- The Pros and Cons of Using Venmo

- Venmo vs. Other Payment Apps: What’s the Difference?

- How Businesses Can Use Venmo

- Downloading the Venmo App

- How to use Venmo

- Venmo FAQs

- 1. What kind of app is Venmo?

- 2. Is Venmo safe to use?

- 3. How do I sign up for Venmo?

- 4. Does it cost money to use Venmo?

- 5. How fast do Venmo payments happen?

- 6. Is Venmo for personal use or business?

- 7. Can I transfer Venmo money to PayPal?

- 8. Does Venmo work internationally?

- 9. What payment methods can I use on Venmo?

- 10. Is Venmo appropriate for business?

- Closing Thoughts on Venmo

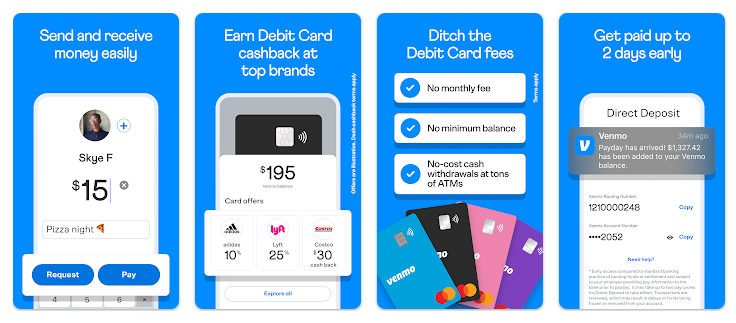

Venmo is a mobile payment service that has become hugely popular in recent years. The app, owned by PayPal, allows users to instantly send and receive money from friends and family. Venmo streamlines the process of splitting bills, paying someone back, and sharing costs.

With Venmo, you can easily transfer money digitally in just a few taps. It’s designed for smaller, daily transactions rather than large payments. Venmo is free when using bank accounts or Venmo balances, but charges a 3% fee for payments made with credit cards.

In this comprehensive guide, we’ll cover everything you need to know about Venmo, including:

- What Venmo is and how it works

- Linking bank accounts and cards

- Sending and requesting money

- Fees and charges

- Social feed and privacy

- Security and safety tips

- Pros and cons of using Venmo

- Venmo vs other payment apps

- How businesses can use Venmo

Let’s get started exploring the Venmo phenomenon!

What is Venmo and How Does It Work?

Venmo is a free digital wallet app and money transfer service for sending and receiving funds. It’s available as a mobile app for iOS and Android devices.

The platform handles the entire payment process within Venmo. You can easily send money to friends, split bills, and make purchases using your Venmo balance, bank account, or debit/credit card linked to your account.

To get started, you simply:

- Download the Venmo app and set up an account by adding basic personal information and linking a bank account and/or card.

- Find friends on Venmo either from your phone contacts or by username.

- Once connected, you can begin sending them money instantly for free.

- Payments between Venmo users happen immediately. You can add notes saying what a payment is for.

- If you want to cash out the money to your regular bank account, you must manually transfer it from your Venmo balance. This takes 1-3 business days.

Some key things that make Venmo so convenient:

Fast transfers: Money is rapidly transferred between Venmo accounts. As soon as the recipient approves it, the money is in their Venmo wallet.

User-friendly: The app is straightforward with an intuitive interface. Easy to set up, find friends, and make quick payments on-the-go.

Transfer notes: You can write a note or emoji for what the payment is for like “Dinner last night” or “Group gift ????” to add context.

Notification alerts: You get notified when money is requested from you or received by you via text, push notification, or in-app alerts.

Built-in security: Venmo uses encryption, authentication, and fraud monitoring tools to protect payments and accounts.

Overall, Venmo simplifies splitting shared costs or sending money to friends. It’s like digital cash moving instantly between users all on your phone.

Linking Your Bank Account and Cards to Venmo

To send or receive money with Venmo, you need to link at least one bank account or card.

During account setup, Venmo gives you the option to securely connect your:

Bank account - Link your debit card/bank account details. You can link multiple bank accounts. Transfers from bank accounts have no fee.

Credit/debit card - Input your card information directly. You can add multiple cards like credit cards, debit cards, prepaid cards.

Here are some things to keep in mind when linking accounts and cards:

The process is simple, requiring you to input your account username, password, and potentially answering security questions.

Venmo uses encryption and authentication like two-factor verification for secure linking.

Your full card number is never shown on Venmo. For privacy, you’ll see the last 4 digits only.

Bank transfers usually take 1-3 business days to complete after you cash out your balance. Debit/credit cards are faster.

You can use money in your Venmo balance to send instant transfers. Funds in your balance are from cash outs or payments.

Without any linked accounts, you can still make payments between Venmo friends using your Venmo balance alone.

Linking your outside accounts to Venmo creates a quick conduit for money to flow in and out of the app. Remember it’s always free to receive money and transfer between Venmo accounts instantly.

Sending and Requesting Money on Venmo

Sending payments is fast and easy with Venmo. Between Venmo friends, money can flow instantly and freely. Here are the ins and outs of making payments:

To send money:

Open the Venmo app and tap the “Pay or Request” button.

Enter the username or pick a friend from your connected friends list.

Enter the amount you want to pay and select the account or card source.

Add a note or emoji for context if you’d like.

Tap “Pay” and the friend will get a notification of your payment.

To request money:

Tap “Request” on the main Venmo interface.

Pick a friend to request money from and enter the amount.

Add a note like “For lunch yesterday”.

The friend will then get a notification of your money request.

A few other sending/receiving notes:

Sending money between Venmo friends is always completely free.

The recipient has to approve the money before it enters their Venmo balance.

You can also make payments to people not on Venmo yet using their phone number or email.

Money in your Venmo balance can be instantly accessed to make payments.

You can easily split bills and costs with groups using Venmo’s split payments feature.

Venmo makes it effortless to exchange money digitally. Payments happen rapidly between connected users on the platform.

Venmo Fees and Charges

Venmo offers a mix of free transfers along with some fees depending on the type of transaction. Here’s a breakdown of Venmo’s pricing structure:

Venmo to Venmo payments - Always completely free. Transfer money between Venmo friends with no fees.

Instant transfers - Free if done from your Venmo balance or linked bank account. 3% fee applies for instant transfers when using a credit card.

Standard transfers - Free. Takes 1-3 days for money to move into your bank account when cashing out your balance.

Merchant payments - Free when using your balance, bank account, or debit card. 3% fee when paying with a credit card at approved merchants.

Venmo Card purchases - The Venmo debit card is free. It pulls from your Venmo balance. Regular debit card fees apply.

ATM Withdrawals - Free withdrawals are available within your plan’s limit at eligible ATMs. Fees can apply after going over the limit.

Some other notes about Venmo’s pricing:

There are no monthly fees or minimum balance requirements to use basic Venmo services.

You get stronger security tools and limits with a no-fee Venmo account. Higher limits require ID verification.

Custom or rush delivery of the Venmo Card will have fees attached. The regular no-fee option for delivery takes 7-10 days.

Venmo offers a ton of flexibility with mostly free flows of money between users. Just be aware of fees for instant credit card transfers or merchant payments.

Venmo’s Social Feed and Privacy Settings

A unique aspect of Venmo is its social, news feed-style interface showing recent payments between friends. However, you have controls over the privacy of transactions and information shown.

Venmo’s social feed includes:

A main feed of recent payments between people you’re connected to

Activity showing payments you’ve sent and received

The ability to like and comment on payments

Emojis and notes giving payment context

Profile pages showing past transactions

Custom privacy settings:

Public: Anyone can see your payments

Friends: Only people connected as friends can view

Private: Payments are private and do not show in the feed

In your account settings you can:

Choose your default privacy setting for payments

Hide your friend list and profile from public view

Limit notifications and block certain users

Turn off location sharing

Venmo automatically has limited privacy controls in place. But adjusting settings ensures you share information only with trusted friends.

Security and Safety Tips for Venmo

Venmo incorporates security measures like encryption and fraud monitoring to protect accounts and payment information. However, it’s important to follow safety best practices on the platform.

Here are key tips for staying secure on Venmo:

Only connect with friends you actually trust. Don’t add strangers.

Use unique logins not shared on other apps to prevent hacking.

Never send money to someone you don’t know personally or at least verified legitimately.

Activate notifications so you are alerted to account activity right away.

Closely monitor your bank account linked to Venmo and report unauthorized charges.

Do not use Venmo for business transactions or buying/selling with strangers.

Use privacy settings to limit financial information sharing with public users or vague connections.

Contact Venmo customer support immediately if you encounter fraudulent activity.

Exercising caution around unknown users and keeping login details secure allows you to safely benefit from Venmo’s digital money transfers.

The Pros and Cons of Using Venmo

Venmo is immensely popular, but is it right for your money transfer needs? Here’s an overview of key advantages and disadvantages:

Pros:

Easy peer-to-peer payments between friends

Quick transfers completed rapidly on mobile

Ability to easily split costs and pay people back

Seamless integration with PayPal for transfers

Generally no fees for bank/balance transactions

Touch ID and PIN code for security

Cons:

Potential privacy concerns with semi-public feed

Requires bank account or card linkage for full functionality

Possible scam risks from shady users

3% fee for instant transfers with credit card

Delays transferring out from Venmo balance to bank

Higher limits require ID verification

The pros like convenient transfers and no fees make it very useful for personal connections. But be aware of risks from public exposure or unknown users when sending money.

Venmo vs. Other Payment Apps: What’s the Difference?

How does Venmo compare against other popular payment apps like PayPal, Zelle, Cash App, and Apple Pay? Here’s a quick rundown:

PayPal - Owned by the same company. Integrates with Venmo balance. More suited for larger online purchases versus daily costs.

Zelle - Bank-based digital transfers. Doesn’t have a social feed. Requires bank integration and eligible U.S. bank account.

Cash App - Focused on individual cash transfers. Can buy/sell bitcoin. No social newsfeed or comments.

Apple Pay - Made for in-store contactless iOS purchases. Does not allow direct peer-to-peer money transfers.

Overall, these apps have overlaps but Venmo’s social sharing and quick transfers between friends make it favorable for splitting everyday expenses and bills.

How Businesses Can Use Venmo

Beyond person-to-person payments, businesses can leverage Venmo in certain ways:

Accept payments for services - Venmo offers a Business Profile option for companies to easily accept customer payments.

Buy goods - Customers can pay businesses for items directly through Venmo. Useful at places like flea markets.

Collect donations - Nonprofits and charitable organizations can use a Business Profile and share their Venmo username to collect donations.

Pay remote workers - Employers can instantly pay workers through Venmo rather than issuing physical checks.

Reimburse employees - An easy way for employees to front an expense, make the purchase through Venmo, and get reimbursed by their company.

Pay freelancers/contractors - Useful for hiring one-off freelancers, having them invoice you, and directly paying via Venmo.

While not a full merchant solution, Venmo provides an additional way for businesses and independent workers to send, receive, and collect payments.

Downloading the Venmo App

Our website provides multiple options for downloading the Venmo app for Android and iOS devices. This includes direct APK downloads for the latest and old versions.

Downloading the Latest Venmo APK

To download the latest Android APK for Venmo:

- Scroll to the bottom of the Venmo app page.

- Click the “Download Latest APK” button.

- This will immediately start downloading the newest version of the Venmo Android APK.

- Once downloaded, you can install the APK file directly on your Android device.

Downloading Older Venmo Versions

Our site also lets you access older versions of the Venmo app:

- At the bottom of the page, click “Old Versions of App”.

- This will take you to a page listing all previous Venmo versions.

- Tap the version you want. For example, “Venmo v8.35.0”.

- Click the “Download APK” button on that version’s page to download the APK file.

- Install the downloaded older APK on your device.

Getting Venmo on the App Store and Play Store

Additionally, we provide quick access to download Venmo from the official app stores:

- The Venmo app page has direct links to the Play Store and App Store near the top.

- Click the iOS or Android button to open the Venmo listing in the respective store.

- Download and install Venmo directly from Google Play or the App Store.

How to use Venmo

Setting Up Your Venmo Account

After downloading the app, it’s time to set up your Venmo account. This is a quick and easy process.

When you open the Venmo app for the first time, tap Sign Up to get started.

You’ll need to enter some basic personal information:

- Email address

- Phone number

- Password

Venmo will send a verification code to your phone to confirm your number.

Next, you can find friends who are already on Venmo by importing contacts from your phone or connecting to Facebook.

If you skip this step, you can always find friends later using their usernames or phone numbers.

Finally, Venmo will ask you to add a profile picture to personalize your account. You can skip this and add one later too.

Once your account is created, you’re ready to start using Venmo!

Linking Payment Sources

Venmo lets you seamlessly send money between friends. To get started sending and receiving payments, you need to link:

- Bank account

- Debit or credit card

In the Venmo app, tap the profile icon in the top right corner.

Then tap Payment Methods > Link New Bank or Card.

You can securely link your bank accounts by providing your account number and routing number.

For credit/debit cards, enter your card information directly.

Adding payment sources means transfers can pull money from your bank or cards. It also lets you deposit funds received into your account.

You can add multiple bank accounts and cards too.

Making Payments to Friends

Sending money to friends on Venmo takes just a few quick taps!

To pay someone, open Venmo and tap the Pay button at the bottom.

Enter the username or pick a friend from your friends list.

Type the payment amount and choose if you want to pay from your Venmo balance, bank, or card.

You can also add a note like “Lunch yesterday!” so your friend knows what the payment was for.

Finally, tap Pay and the money will transfer instantly to your friend’s Venmo account. They’ll get a notification that you paid them.

Paying people back has never been easier!

Requesting Money

You can conveniently request money owed to you too.

Tap the Request button on the main Venmo interface.

Select a friend to request money from.

Enter the amount and add a note about what you’re requesting money for.

The friend will receive your request and can then pay you for the amount owed.

Social Feed

One fun feature in Venmo is the social feed showing recent payments between you and your friends.

It’s like getting to see a social media feed of money being exchanged. You can even like or comment on payments.

Keep in mind payments show up here only between mutual friends. You can change your privacy settings if you don’t want them to appear in the public social feed.

Cashing Out Your Balance

Money you receive or add yourself goes into your Venmo balance for easy transfers. But how do you actually get it into your real bank account?

In the app, go to your account settings and find Cash Out.

You can instantly transfer your full balance or a portion of it back to your bank account on file.

The money will typically take 1-3 business days to appear in your regular bank account once cashed out.

Venmo Card

For even more flexibility, you can sign up for the optional Venmo debit card.

The Venmo Card lets you instantly spend money from your Venmo balance anywhere that accepts debit cards. It functions like a regular debit card.

To apply for the card, just go to your profile settings and tap Get Venmo Card.

The card itself is completely free. You’ll just pay standard debit card fees for things like ATM withdrawals.

That’s It, Get Started!

And that’s the basics of setting up your account, linking payments, sending/receiving money, and using the Venmo app!

Venmo makes it incredibly fast and convenient to exchange money with friends.

You can avoid IOUs, easily split shared expenses, pay people back, and transfer money without cash or checks.

Once you get the app downloaded and connected to your bank or cards, you’ll be on your way to seamless mobile payments.

Now go give Venmo a try and see for yourself how easy digital money transfers can be!

Venmo FAQs

1. What kind of app is Venmo?

Venmo is a popular mobile payment app that allows you to easily and quickly transfer money between friends and family. It’s a free peer-to-peer payment service great for splitting shared expenses like rent, utilities, dinner costs, etc.

2. Is Venmo safe to use?

Yes, Venmo utilizes encryption technology and fraud monitoring to keep your account and information secure when sending payments. As long as you use strong payment credentials and only transact with people you know and trust, Venmo is generally safe to use.

3. How do I sign up for Venmo?

Download the Venmo app on your iOS or Android device. Then create an account with your email, mobile number, and bank account information. You can also sign up on the web at venmo.com.

4. Does it cost money to use Venmo?

Venmo is free to use for most types of transactions like sending money to friends from your Venmo balance or bank account. The only fees are for instant transfers from a credit card (3%) or business transactions.

5. How fast do Venmo payments happen?

Venmo payments between users are practically instantaneous. Money is immediately available in your Venmo account to pay others. However, instant bank withdrawals will take 1-3 days to transfer to your regular bank account.

6. Is Venmo for personal use or business?

Venmo is mainly designed for personal payments between friends and family. Business accounts are allowed but have higher fees. For broader business and merchant needs, PayPal or Square may be better choices.

7. Can I transfer Venmo money to PayPal?

Yes! Since PayPal owns Venmo, you can easily transfer funds between Venmo and PayPal in either direction as long as you have accounts with both services.

8. Does Venmo work internationally?

Currently, Venmo is restricted to users with U.S. based accounts and mobile numbers. Venmo does not support international payments in different currencies yet.

9. What payment methods can I use on Venmo?

You can link bank accounts, debit cards, credit cards, and prepaid debit cards to your Venmo account. Money can be pulled from any of these sources to make payments.

10. Is Venmo appropriate for business?

Venmo is mostly geared for personal use, but business owners can sign up for a Venmo Business Profile to accept payments for goods/services. However, there are higher fees so other services may be better suited for full merchant needs.

Closing Thoughts on Venmo

As digital payments continue evolving, Venmo has carved out an extremely popular niche for quick, social money transfers between friends and individuals. It simplifies splitting routine purchases and bills while integrating seamlessly with your other accounts.

Venmo is free for most bank-based transactions and optimized for smaller amounts under $3000. While you need some caution around privacy and security, the platform can be a game changer for simplifying payments and reducing cash dependence.

With mobile-first convenience, real-time transfers, and a newsfeed to interact with friends, Venmo delivers an engaging spin on how money moves. The app continues advancing innovative ways for people to connect financially.