|

Name:

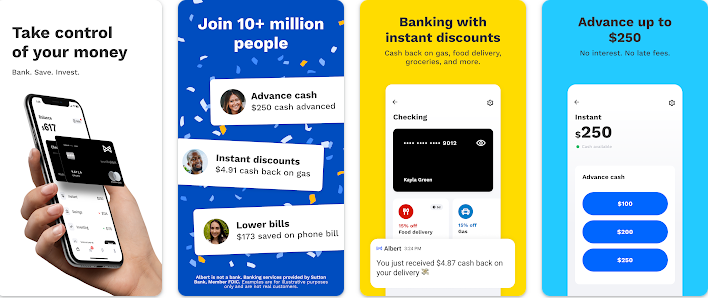

Albert: Banking on you

|

|

|

Version:

6.4.0

|

Price:

Free

|

Updates

Here are some of the new features included in the latest version of the Albert: Banking on You App:

- New features:

- Albert Insights: Albert Insights is a new feature that provides you with insights your spending habits. This feature uses machine learning to analyze your spending data and provide you with insights where your money is going.

- Albert Goals: Albert Goals is a new feature that allows you to set financial goals and track your progress towards those goals. This feature can help you stay on track with your financial goals and reach them sooner.

- Improved user interface:

- New look: The app’s design has been d to give it a more modern look and feel.

- New features: The app has been d with a number of new features, such as the ability to view your recent transactions and to save your favorite merchants.

- Bug fixes and performance improvements:

- A number of bugs have been fixed in the latest version of the app. These bugs were causing problems for some users, but they have now been fixed.

- The app has also been optimized for better performance. This means that the app will run more smoothly and will be less likely to crash.

If you’re looking for an app to help you manage your finances, then the Albert: Banking on You App is a great option. The latest version of the app includes a number of new features that will make your experience even better.

Albert is a mobile banking app that helps you manage your money. It offers a variety of features, including:

- Automatic savings: Albert can automatically save money from your paycheck a savings account.

- Cash advances: Albert can advance you up to $250 from your next paycheck, with no interest or fees.

- Investment options: Albert offers a variety of investment options, including stocks, bonds, and ETFs.

- Genius service: Alberts Genius team of money experts is available 24/7 to answer your questions and help you reach your financial goals.

Pros

Albert is a convenient way to manage your money. You can access your accounts from anywhere, and you can easily transfer money between accounts. Albert also offers a variety of features that can help you save money and reach your financial goals.

Cons

Albert is not a bank. It does not offer FDIC insurance, and it is not subject to the same regulations as banks. This means that your money is not as secure as it would be if you were banking with a traditional bank.

How to use Albert

To use Albert, you first need to create an account. Once you have created an account, you can connect your bank accounts to Albert. Albert will then automatically start tracking your spending and saving money. You can also manually add transactions to Albert.

FAQs

- Is Albert safe?

Albert is a secure app. It uses the latest security measures to protect your money. - Does Albert offer FDIC insurance?

No, Albert does not offer FDIC insurance. - What are the fees for Albert?

Albert does not charge any fees for its basic features. However, it does charge fees for some of its premium features, such as cash advances. - How can I get help with Albert?

Alberts Genius team of money experts is available 24/7 to answer your questions and help you reach your financial goals. You can contact them by phone, email, or chat.

Conclusion

Albert is a convenient and easy-to-use mobile banking app that can help you manage your money. It offers a variety of features, including automatic savings, cash advances, and investment options. Albert is not a bank, but it is a safe and secure way to manage your money.