|

Name:

GO2bank

|

|

|

Version:

1.31.0

|

Price:

Free

|

Updates

Here are the new features in the latest version of GO2bank App:

- New user interface: The new user interface is more modern and user-friendly. The buttons and menus have been redesigned, and the app now uses a dark theme by default.

- Improved savings features: The app now includes improved savings features, such as the ability to set up automatic savings and the ability to earn interest on your savings.

- New features for budgeting: The app now includes new features for budgeting, such as the ability to track your spending and the ability to create budgets.

- Bug fixes and performance improvements: The app has been d to fix a number of bugs and improve performance.

These new features make it even easier to manage your finances with the GO2bank App. Whether you’re looking to save money, budget your spending, or just keep track of your finances, the latest version of the GO2bank App has something for you.

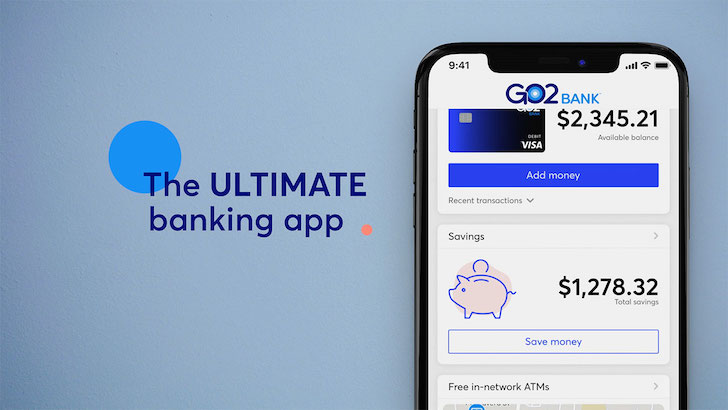

GO2bank™ is a mobile banking application that offers a wide range of features to help people manage their finances and build credit. Its the perfect financial solution for tech-savvy consumers who want a simple, cost-effective banking experience that can help them achieve their financial goals. Available for download on the App Store or Google Play, GO2bank™ offers its users many benefits that traditional banking institutions cant match.

GO2bank™ offers an impressive range of features that can help users manage their money more effectively, such as:

- No Monthly Fees: Eligible direct deposit users can enjoy the apps powerful financial tools for free.

- Free Nationwide ATM Network: No matter where you are in the country, GO2bank™ can help you get access to your money quickly and easily.

- Overdraft Protection: Avoid the fees and headaches that come with overdrafts by signing up for GO2bank™s optional overdraft protection feature.

- Early Paycheck Access: Get your pay up to 2 days early with direct deposit!

- Higher Savings Rate: The app is designed to help users save more of their money by offering a savings account with a competitive interest rate.

One of the biggest advantages of using GO2bank™ is the apps convenience. With the ability to check accounts and access funds from anywhere, users can keep a close eye on their finances and make better financial decisions easily. Additionally, GO2bank™s wide range of features means users can accomplish almost everything they need financially all within the same app.

While GO2bank™ offers many advantages for consumers, its essential to note some of its drawbacks. One of the most significant issues associated with the app is that it may not be as robust as some traditional banking institutions that have been around for years. For example, Although GO2bank™ has a fee-free ATM network, some ATMs may impose additional charges.

Getting started with GO2bank™ is simple and straightforward. Once downloaded, users need to fill out a short application to open a deposit account. Afterward, they can link their existing bank accounts and get started with the apps numerous features.

FAQs:

1. Is GO2bank™ secure?

Yes, GO2bank™ is a brand of Green Dot Corporation, which is a member of the Federal Deposit Insurance Corporation (FDIC). FDIC insurance protects depositors up to $250,000 per account holder.

2. Can I use GO2bank™ without a smartphone?

No, GO2bank™ is a mobile-only banking application that can be downloaded from the App Store or Google Play.

3. Is there a minimum deposit to open a GO2bank™ account?

No, there is no minimum deposit required to open an account with GO2bank™.

If youre looking for a straightforward, all-in-one solution for managing your finances, then GO2bank™ may be exactly what youre looking for. With its no-fee checking account, wide range of features and benefits, and mobile application usability, GO2bank™ is one of the most user friendly and convenient financial apps on the market today.